15/12/2025

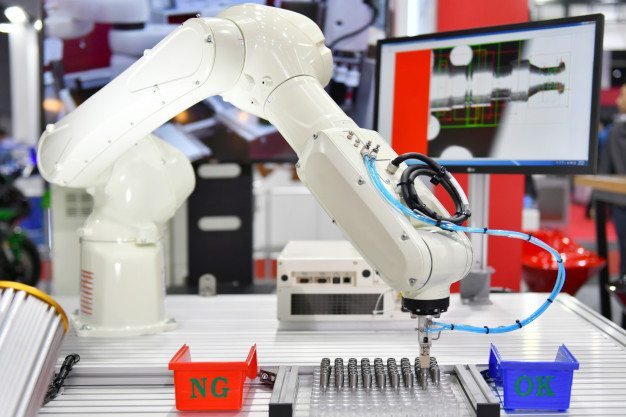

InnovaFonds entre au capital du Groupe CVA pour accélérer son développement et accompagner sa diversification stratégique

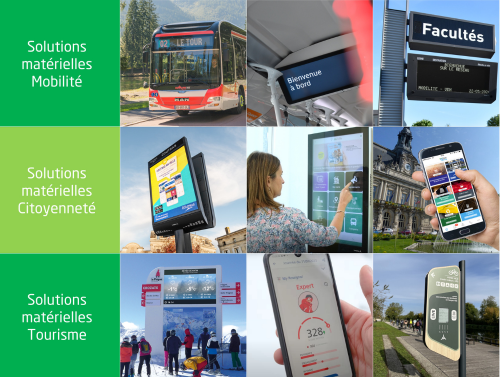

InnovaFonds entre au capital du Groupe CVA, en tant qu’actionnaire minoritaire, aux côtés de ses dirigeants fondateurs, Pierre Vinour et Étienne Cavallucci, actionnaires majoritaires. Cette opération vise à accompagner le groupe dans une nouvelle phase de croissance et à soutenir l’accélération de sa stratégie de diversification.