InnovaFonds gère plus de 500 M€ à travers cinq véhicules d’investissement.

L’équipe de gestion a réalisé plus de 40 opérations et 15 cessions.

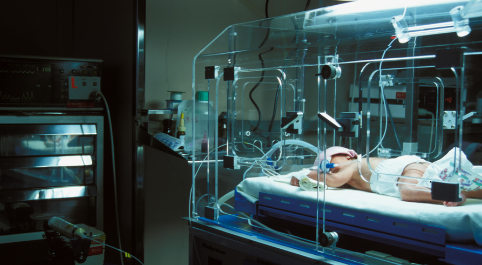

Néonatalogie

Collecte, tri, recyclage et valorisation de matières

Conteneurs techniques pour Aéronautique-Spatiale-Défense

Bureau d'études pour actifs industriels et logistiques

Services TIC pour infrastructures de transport durables

Bureau d’études techniques pluridisciplinaire

Direction à temps partagé augmenté pour PME/ETI

Intégrateur de solutions de paiement en points de vente

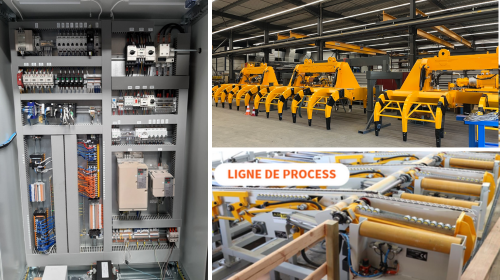

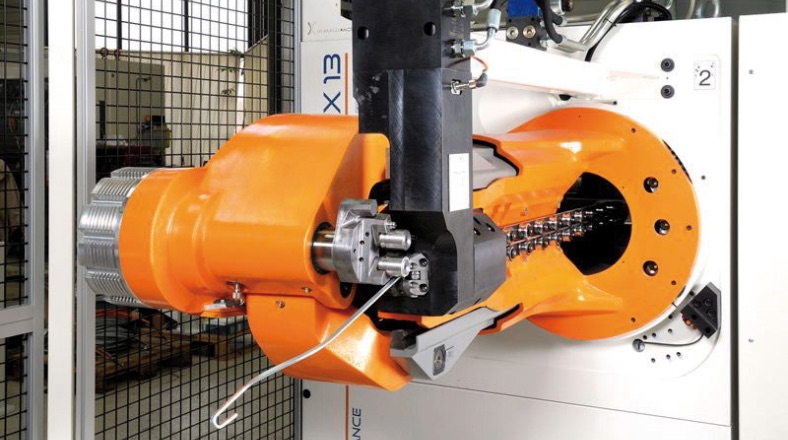

Intégrateur global de systèmes industriels clés en main

Fabrication de textiles techniques

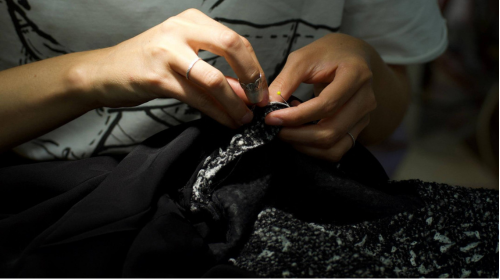

Façonnier et bureau d'études pour le prêt-à-porter de luxe

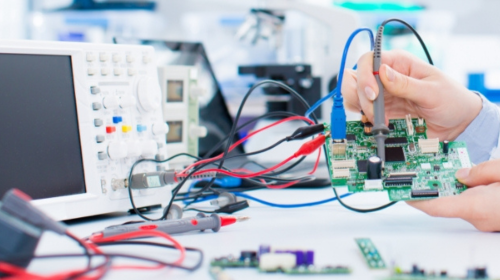

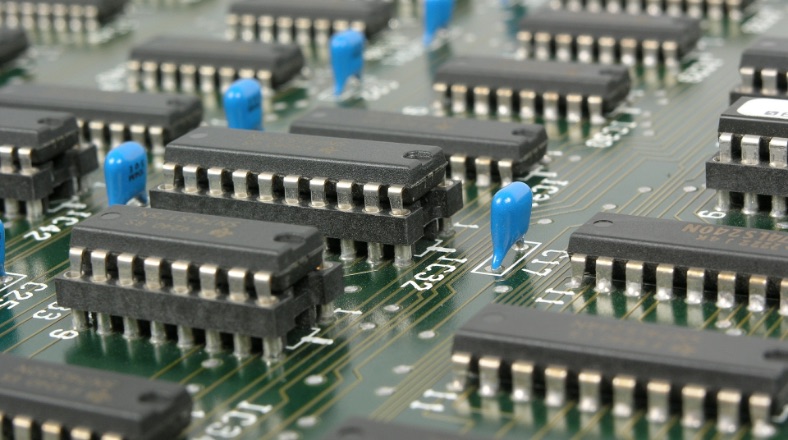

Maintenance électronique B2B et Monitoring industriel

Conception d’équipements de signalisation ferroviaire

Conception de solutions d'affichage dynamique

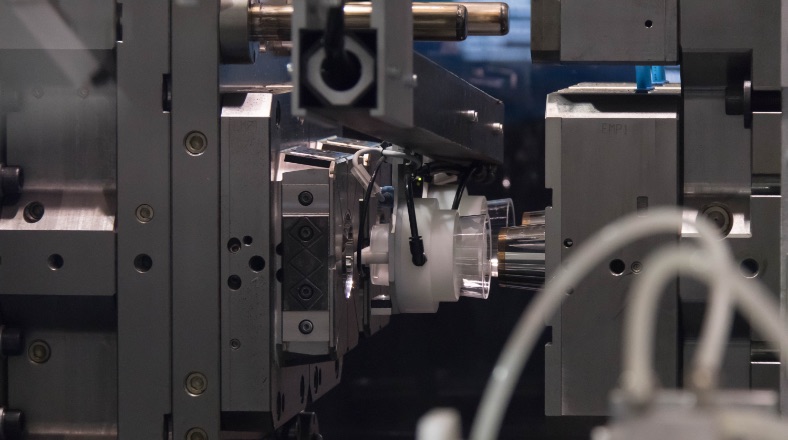

Conception de solutions d’emballages

Conception et fabrication d’engins rails/routes

Création et confection de vêtements professionnels

Expert du transfert d’entreprise et du déménagement premium

Produits techniques de sécurité pour l'industrie du gaz

Conseil, expertise technique aux industries de haute technologie

Systèmes d’alimentation sans interruption

Fabrication de plans de travail en pierres naturelles

Nettoyage de bacs réutilisables pour l'industrie agro

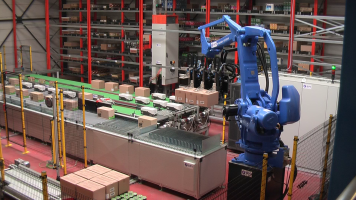

Robotique et automatisation pour les secteurs de l'emballage et du médical

Solutions industrielles de productivité

Solutions de liaisons d’armatures

Décontamination et nettoyage ultra-propre

Produits de sonorisation et de lumière

Domotique et équipements électriques

Fabrication de textiles techniques

Travaux d'accès difficile

Conditionnement industriel et logistique

Connecteurs critiques pour l’industrie ferroviaire

Fabrication de béton prêt à l'emploi

Pompes et Aiguilles de dosage-remplissage

Instruments d’analyse scientifique portables

Solutions en téléphonie IP

Fours industriels de traitement thermique

Equipements de métrologie

Analyse et mesure de la qualité de l'air

Equipements pour l'imagerie et l'électronique

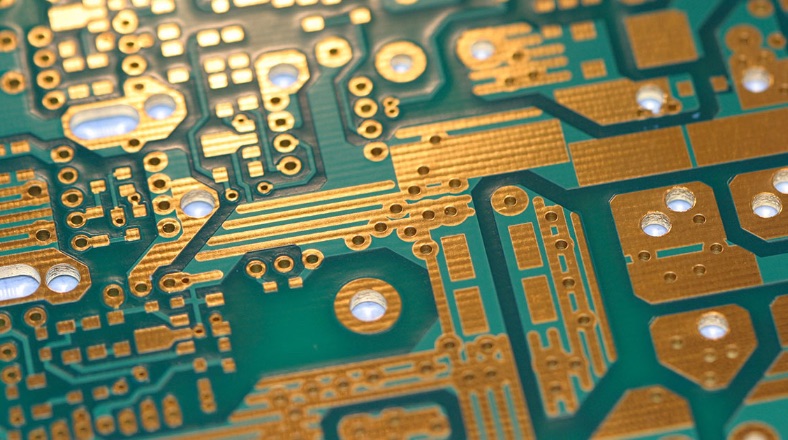

Fournisseur de circuits imprimés et pièces sur plan

Solutions d'analyse acoustique et vibratoire

Electronique embarquée