InnovaFonds gère plus de 350 M€ à travers cinq véhicules d’investissement.

L’équipe de gestion a réalisé 30 opérations et 14 cessions.

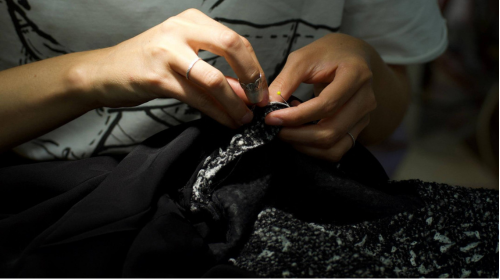

Façonnier et bureau d'études pour le prêt-à-porter de luxe

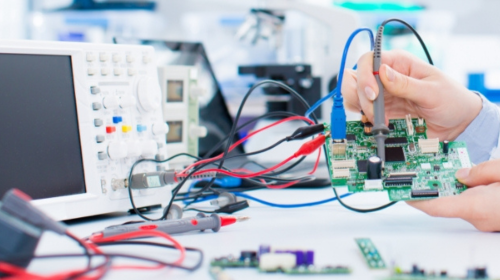

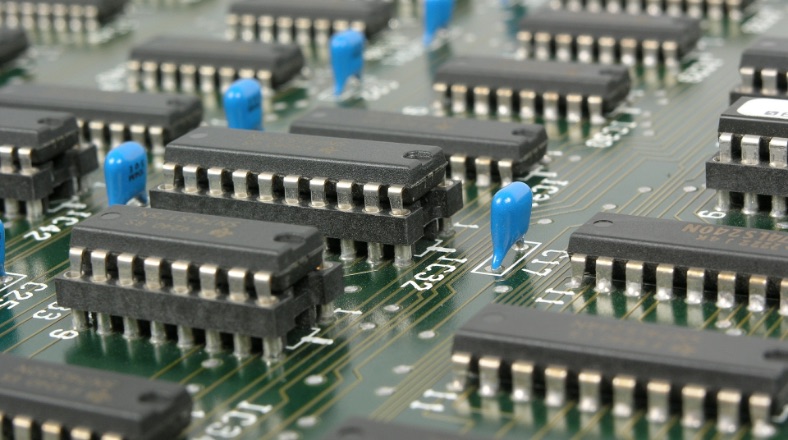

Maintenance électronique B2B et Monitoring industriel

Conception d’équipements de signalisation ferroviaire

Conception de solutions d'affichage dynamique

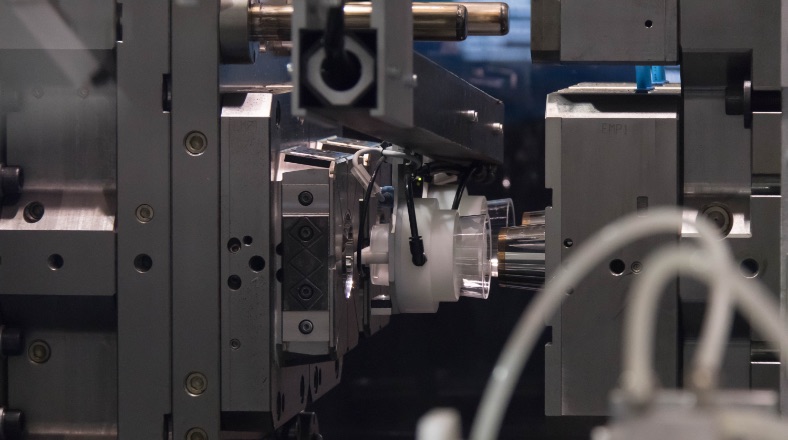

Conception de solutions d’emballages

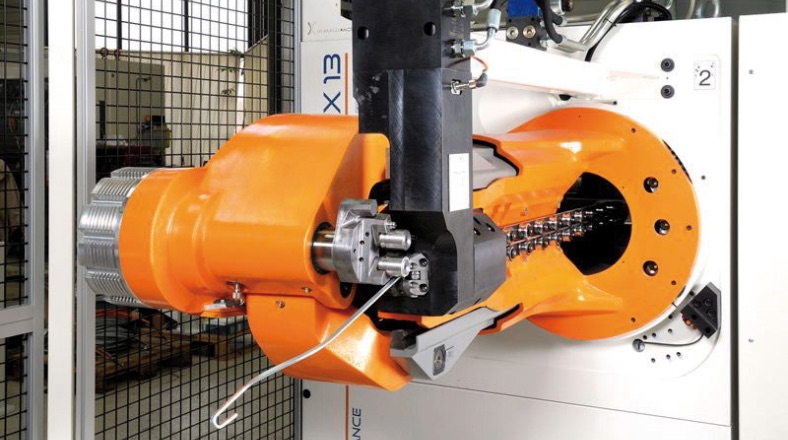

Conception et fabrication d’engins rails/routes

Création et confection de vêtements professionnels

Expert du transfert d’entreprise et du déménagement premium

Produits techniques de sécurité pour l'industrie du gaz

Conseil, expertise technique aux industries de haute technologie

Systèmes d’alimentation sans interruption

Fabrication de textiles techniques

Fabrication de plans de travail en pierres naturelles

Nettoyage de bacs réutilisables pour l'industrie agro

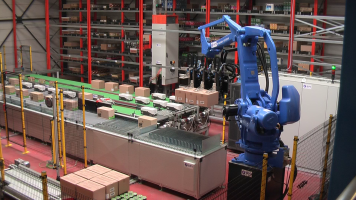

Robotique et automatisation pour les secteurs de l'emballage et du médical

Solutions industrielles de productivité

Solutions de liaisons d’armatures

Décontamination et nettoyage ultra-propre

Conditionnement industriel et logistique

Travaux d'accès difficile

Produits de sonorisation et de lumière

Domotique et équipements électriques

Connecteurs critiques pour l’industrie ferroviaire

Fabrication de béton prêt à l'emploi

Pompes et Aiguilles de dosage-remplissage

Instruments d’analyse scientifique portables

Solutions en téléphonie IP

Fours industriels de traitement thermique

Equipements de métrologie

Analyse et mesure de la qualité de l'air

Equipements pour l'imagerie et l'électronique

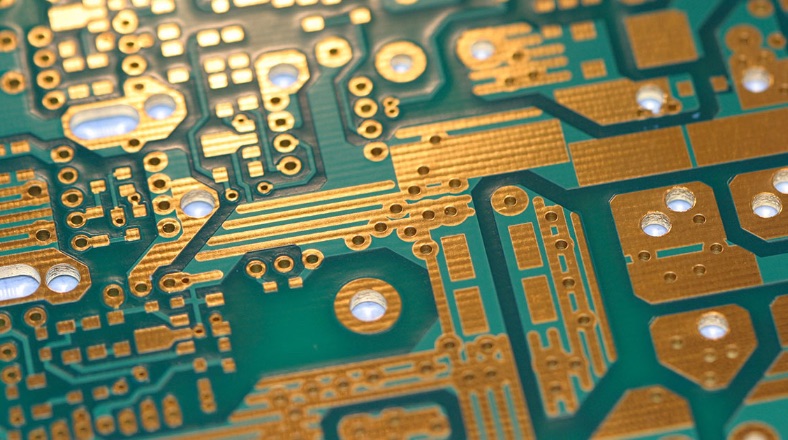

Fournisseur de circuits imprimés et pièces sur plan

Solutions d'analyse acoustique et vibratoire

Electronique embarquée